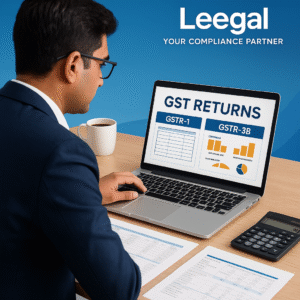

🌟 Product Overview:

Leegal’s ITR Filing for Business and Professionals is a specialized income tax compliance service crafted for individuals and entities earning income from business, freelancing, consultancy, or professional practice. Whether you operate as a proprietorship, small trader, consultant, doctor, architect, or freelancer, our experts ensure accurate filing, full compliance, and optimized tax savings in line with the latest provisions of the Income Tax Act, 1961.

We help MSMEs, startups, and independent professionals navigate complexities like Presumptive Taxation (Section 44AD/44ADA), Books of Accounts, GST linkage, and Balance Sheet preparation with absolute precision.

🕒 Processing Time:

24–48 hours post document submission & verification

🧠 Why Choose Leegal?

✔️ Professional support by Tax Experts & Chartered Accountants

✔️ Accuracy-driven compliance under the new regime

✔️ Advisory to minimize tax liability legally

✔️ PAN-India remote filing assistance

✔️ Seamless GST–ITR data integration

Reviews

There are no reviews yet.